1031 Exchanges (Tax Deferred)

The attorneys at ESQ.title have over two decades of combined experience in the field of exchanging. Our experience in 1031 Exchanges is a valuable resource to the investor and even the investor’s real estate agent. If you have questions about exchanging, contact us for expert advice. We service our clients in Miami-Dade, Broward and Palm Beach County with the utmost professionalism and give their matter the diligence it deserves.

When a real estate investor sells property for a profit, they are most likely subject to pay tax on that appreciation or gain, unless the property qualifies for preferential tax treatment under Internal Revenue Code.

Section 1031 (IRC §1031) of the Code states:

“No gain or loss shall be recognized if property held for productive use in a trade or business or for investment is exchanged solely for property of like-kind.”

This means that depending on the use of the property, a real estate investor using IRC Section 1031 can exchange vacant land for an income producing apartment, an office building for a shopping center or rental apartments for an office building.

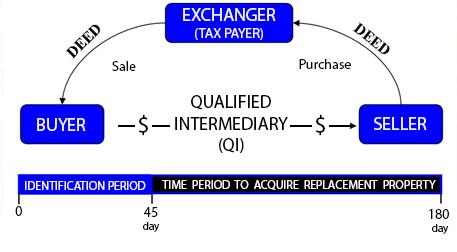

In 1991, Treasury Regulations redefined the “Starker” or delayed exchange, including the 45 day identification requirements for replacement property. These Regulations also encourage the use of a Qualified Intermediary, deeming it a “safe harbor.” A “safe harbor” is a term which defines acceptable guidelines so a transaction will be regarded defensible.

“Benefits of Exchanging”

Prior to the Starker decision, trading properties was difficult. Completing a tax deferred exchange meant properties had to be “swapped” at the same time. Unfortunately, this made exchanging a risky proposition.

The 1979 Starker decision permitted the non-simultaneous or “delayed” exchange to qualify for tax deferral. This gave real estate investors time to locate desirable replacement properties by using an Intermediary.

The 1991 Treasury Regulations validated the delayed exchange and simplified the exchange process. These Regulations which included the use of Qualified Intermediaries, finally created certainty on real estate exchange transactions.

Even today, there are a number of real estate investors and property owners are hesitant in selling for the simple fact they may be subject to pay a high amount of capital gains taxes once they sell. Recent changes still do not offset the benefits of exchanging.

Typically, as an investor’s needs change over the years, the type of investment property they want changes. Relocation, estate building, retirement, desire to increase cash flow, and the need to reduce management responsibilities, could all affect they type of property investors want to own. Under IRC §1031, real estate investors now have an alternative of maximizing their investments into more desirable investment properties.

If you or your business would like to take advantage of 1031 exchanges, the lawyers at ESQ.title are well equipped to answer any of your questions and guide you through the process. In addition to Delayed and Simultaneous exchanges, the commercial real estate attorneys at ESQ.title have extensive experience in commercial real estate transactions for all property types, including but not limited to, NNN single and multi-tenant properties, retail and shopping centers, warehouse/industrial parks, multifamily apartment projects, and office buildings.